Having purchased this past summer a used hybrid vehicle that gives me remarkable fuel economy, I am now a very infrequent customer at the gas pump. My greenhouse gas emissions are much less than was the case with my late 17-year-old car, and that pleases me immensely. The fact that I will also come out even farther ahead in my carbon tax rebate is an additionally pleasing benefit.

Yet according to the propaganda promulgated by lil' PP (and, sadly, now echoed by the NDP), that 'tax' is the source of an insupportable burden on the backs of hardworking Canadians. PP, of course, never lets the facts get in the way of demagogic rants.

However, his denunciation

flies in the face of the fact that 90 per cent of the revenue from the fuel levy is rebated to Canadians — the Parliamentary Budget Officer has found that most households, particularly low-income households, receive more from the rebate than they pay in additional costs.

PP trades in people's ignorance and susceptibility to propaganda. Fortunately, not everyone is buying his "alternative facts", as attested to by these letters to the editor:

Carbon pricing makes sense if you understand it

Poilievre poisoned Canadians against the most effective tool we have for fighting climate change, Sept. 17

An open letter signed by hundreds of economists, followed by another written by Nobel prize winners, called carbon pricing the most effective and cheapest way of reducing emissions. Fee and dividend, as in Canada, is also said to be the fairest model. Who is qualified to come up with a better idea? How a carbon fee changes consumer behaviour is quite simple. The “pain” will be felt and the benefit is in the cheaper alternatives and less wasteful use. Our system has a double benefit: the savings and the rebate are greater than the usage of the average middle-income earner. According to the World Bank, 110 countries had either pricing, taxes or emissions trading. All have the same effect. This includes China where coal use has peaked and more coal plants are being closed than opened. Wind and solar are more environmentally friendly and cost-effective than carbon and are scalable. Canada has the best possible scheme but sadly, it has been watered down due to political pressures. It might be more useful to have opinions from informed parties rather than those who admit they do not understand.

John Peate, Peterborough, Ont.

I’m angry that the Liberals can’t communicate the simple concept that we get back as much as we put in to the quite reasonable carbon levy. Our government has (with a major push from the NDP) set in motion the filling of glaring gaps in our health care system (dental care and prescription drugs) and an affordable child care system. I’m puzzled how they’ve now managed to become so unpopular that we might elect a right wing government that could wipe out all that progress. Ironically, the Star recently had a review of Henrik Ibsen’s play “Rosmersholm” in which a character says “elections used to be won by those who spoke with the most sense, not the most volume.” Enough said!

Garry Watson, Niagara Falls

Wait a minute! The carbon levy has been under sustained attack from the Tories for two years, but it is not dead yet. Conservative Leader Pierre Poilievre has been spreading lies and misinformation about the levy, and I have yet to hear or read any media questioning his position. It is his main talking point, so is it not time to take the gloves off and press him to explain exactly what he means? Poilievre is on shaky ground because he clearly does not understand why a price on carbon is essential. He cannot refute the arguments in favour of the carbon levy and rebate, as stated by knowledgeable economists and scientists, and he has no clue of what a better, more effective alternative might be.

Teresa Ganna Porter, Newmarket, Ont.

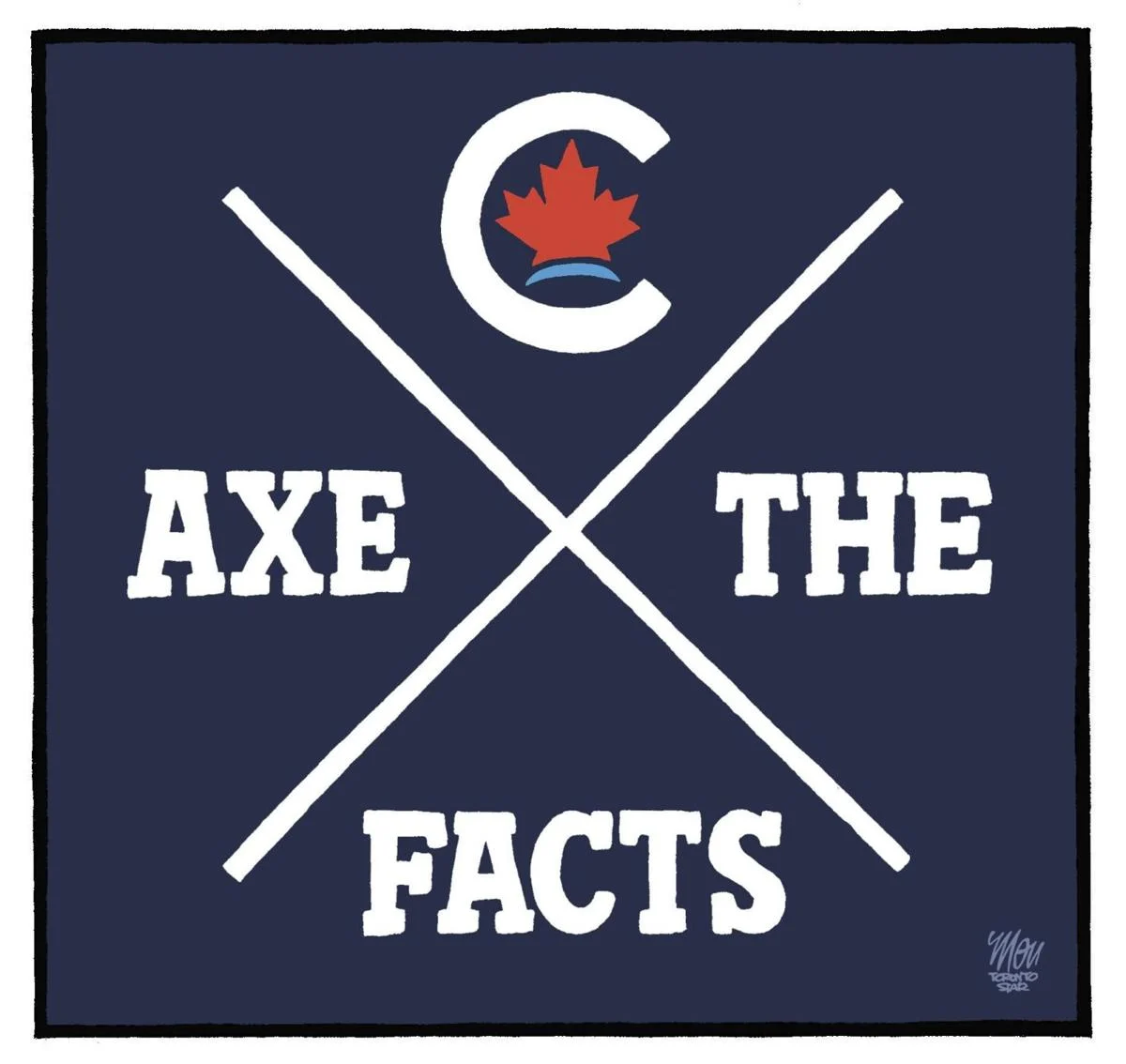

Most people who do not understand the carbon levy, or don’t want to be bothered finding out what it is all about, would rather listen to the other guy at the coffee shop who appears to have read the headline “Axe the Tax” which should read “Axe the Facts.” What does your rebate cover for you? What do you spend it on? Can you balance your budget without it? If you can’t then do not support Conservative Leader Pierre Poilievre’s drive to cancel the levy and rebate. Poilievre is not offering us anything else to fight climate change. And if you are complaining about the gas prices, remember the price of gas always jumps up and down. It isn’t driven solely by carbon pricing.

Beverly Northeast, Goodwood, Ont.

How refreshing to read the truth about carbon taxation in Canada. Studies have shown most Canadians receive more money in rebates than they pay out in carbon tax. How is this not embraced enthusiastically? We get money from the government and feel good about doing our bit for climate change. Conservative Leader Pierre Poilievre has pulled the wool over many Canadians’ eyes just to get elected.

Claire Barrey-Junop, Quinte West, Ont.

It has been said that if a lie is repeated enough times, it becomes the truth. It therefore falls to those of us who can think and don't salivate at the sound of the dog whistle to set the record straight.